Introduction

Model Setting

- Producer: monoploy in the market with private and constant marginal production cost. They are responsible for producing and selling a single product to a unit mass of consumers.

- Consumers

- each consumer has a desire for a single unit of the product, and their preferences are represented by a value distribution.

- The distribution of their values is described by a commonly known market demand

- the values determine their willingness to pay for the product.

- Data Broker: an intermediary between the producer and consumers. Their role is to sell market segmentations to the producer using various selling mechanisms. The data broker collects and sells consumer data to the producer, indirectly help the producer to screen the consumers.

These roles interact within the model to determine the optimal selling mechanisms for the data broker and to analyze the impact of the data broker's actions on economic welfare and allocative outcomes.

Results

optimal selling mechanisms of the data broker

producer only sells to high-value consumers and induces quasi-perfect price discrimination, where all the purchasing consumers pay exactly their values

- consumer surplus under any optimal mechanism is zero, and it is as if all the information about the consumers’ values were revealed to the producer

the cutoff function under any optimal mechanism is exactly the minimum of the (ironed) virtual marginal cost function and the optimal uniform price as a function of marginal cost

market outcomes of data brokership

how would the market outcomes differ if the data broker, instead of merely supplying consumer data to the producers, plays a more active role in the product market?

Variables Definition:

- data brokership

- vertical integration: all the private information about production cost is revealed and the data broker merges with the producer

- exclusive retail: the data broker negotiates with the producer and purchases the product, as well as the exclusive right to sell the product, from the producer

- price-controlling data brokership: the data broker can contract with the producer on prices in addition to providing consumer data.

Findings

- vertical integration between the data broker and the producer increases total surplus while leaving the consumer surplus unchanged

- data brokership is equivalent to both exclusive retail and price-controlling data brokership

An Illustrative Example

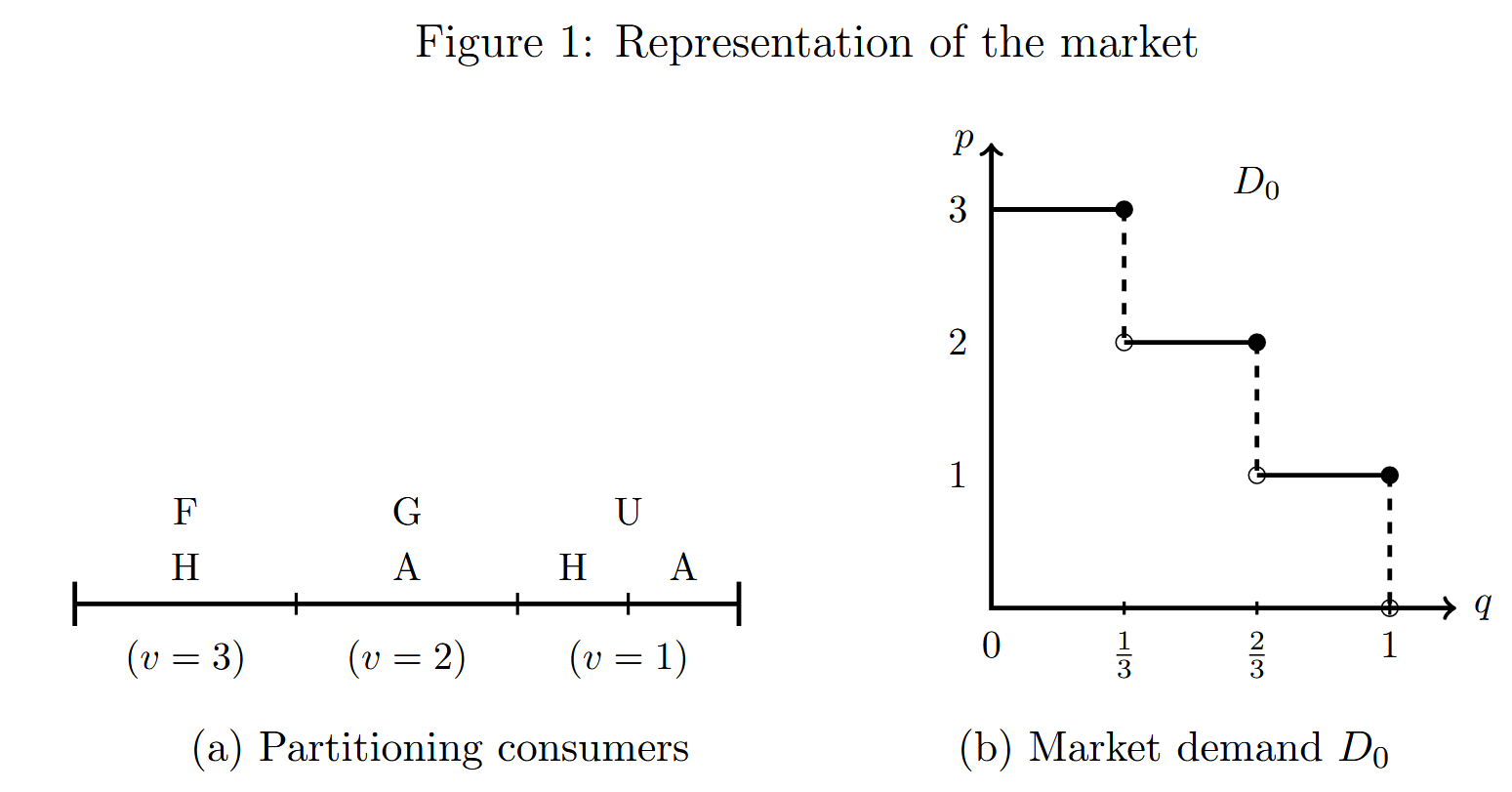

A Textbook Market

A publisherI(producer) sells an advanced textbook with private cost

| Consumers | Evaluations (v) | Livings (houses/apartments) |

|---|---|---|

| Faculty (F) | v=3 | all in houses |

| Undergrad (U) | v=2 | 1/2 in houses and 1/2 in apartments |

| Grad (G) | v=1 | all in apartments |

The data broker sell data to publisher with price

See the figure to illustrate the economy:

Optimal Data Selling

the optimal selling strategy is that data broker designs the information structure:

- consumer type data

- residential data: live in house or apartments

value-revealing data case: sell consumer type data only

when the broker sell the most informative data, it helps the publisher to know consumer types theroughly, and if the publisher buy the data, the net benfit is:

if the publisher do not buy the customer data, the net benfit under optimal uniform price is:

Therefore, the publisher would buy data iff:

since

when

, always buy when

, buy if and should charge

Therefore, for data broker, the optimal price

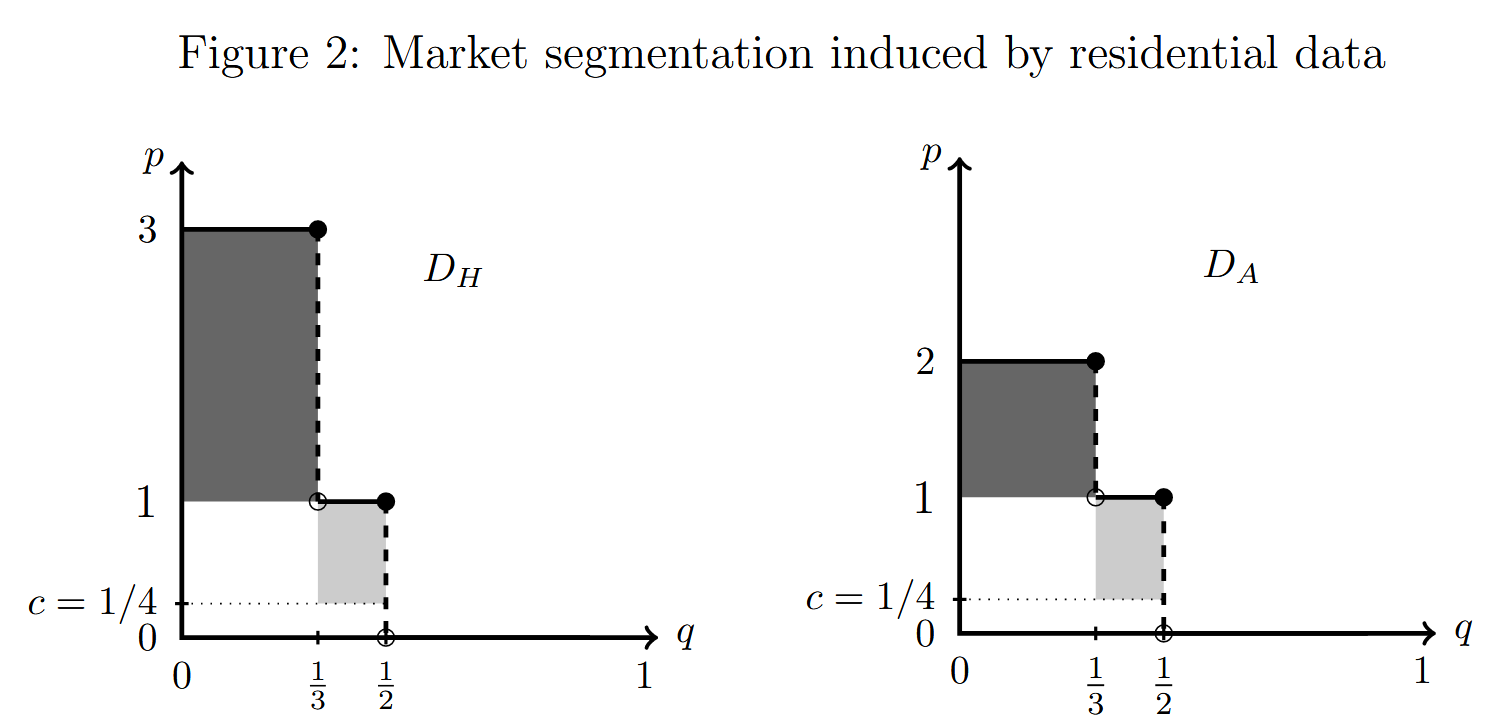

mixed data case

the broker’s revenue can be improved if she sells extra data, in this case, the residential data:

Obviously, more complicated data helps the publisher to segmentize the market two-dimensionally (see fig 2):

: consumers who live in houses : consumers who live in apartments

and now in each sub-market, there are only two possible types.

The optimal mechanism

- when

, the consumer with do not buy, which means that the data broker might sometimes discourage (ex-post) efficient trades. - consumer surplus is zero

- even though every purchasing consumer pays their value, the high-cost publisher never learns exactly each individual consumer’s value

these features also hold in the general environment.