Gneezy, Uri, Silvia Saccardo, Marta Serra-Garcia和Roel van Veldhuizen. 《Bribing the Self》. Games and Economic Behavior 120 (2020年3月1日): 311–24. https://doi.org/10.1016/j.geb.2019.12.010.

摘要

研究问题:自我欺骗👉有偏建议;自我欺骗能力的相关因素;自我欺骗抑制

自我欺骗如何在帮助专家保持自我形象时导致偏见

自我欺骗能力相关:自我欺骗的存在;自我欺骗能力的局限(自我欺骗需要借口)

Parameter Panel:激励机会的提供时间点;自我欺骗的借口数量

实验综述

专家向客户推荐投资中,根据推荐获得佣金

Treatment:改变专家得知存在激励的时间点 → 当动机先于提供建议时,他们更可能产生偏见

论文意思是结果和自我欺骗理论一致(在评估投资建议前就了解激励会影响顾问对投资的信念和偏好)

自我欺骗只要有哪怕很小的借口都存在,但所有借口消失时会消失

如何约束自我欺骗来促进优质建议

1 Introduction

专家建议很重要

在医疗、法律和财务决策等各种领域决策都很重要

【文献】在存在模糊性或主观性的情况下,个体可能会从事自私自利的行为,这使他们能够保持积极的社会或自我形象

(e.g., Kunda, 1990; Konow, 2000; Dana et al., 2007; Haisley and Weber, 2010; Di Tella et al., 2014; Exley, 2015; Grossman and van der Weele, 2017; Gneezy, Saccardo and van Veldhuizen, 2018; Zou, 2018; Bicchieri, Dimant and Sonderegger, 2019)

研究道德顾虑究竟出自对自我形象的担忧(self-image concerns)还是社会形象的担忧(social-image concerns)

探究自我欺骗能力的限制 (所谓借口的多少 ways to convince themselves)

RiskReturn experiment :risk-return tradeoff √ trade-off between their commission and the client’s expected loss √

Dominance experiment :

risk-return tradeofftrade-off between their commission and the client’s expected loss √ObviousDominance experiment:None

实验结论

专家们会主动扭曲自己的信念,使自己能够推荐存在激励的选择

这里面的信念扭曲呢?

为减少错误建议比率,任何自我欺骗的借口余地都必须被消除

研究结果可以帮助法规设计、探讨削弱委员会对建议的影响

通过减少判断中的主观性,或通过强化由有偏见的建议引起的自我形象成本,来减少自我欺骗的范围的干预,需要精心设计,以减少不诚实建议的程度

实验设计

The Advice Game(Sender & Receiver Game)

选择发送一条投资建议A或B

Excuse Experiment

Risk-Return

A —— a 50-50 lottery between $2 and $4

B —— a 50-50 lottery between $1 and $7

Dominance Experiment

A —— a 50-50 lottery between $2 and $4

B —— a 50-50 lottery between $2 and $6

Obvious-Dominance Experiment

A —— a 50-50 lottery between $2 and $4

B —— a 50-50 lottery between $5 and $7

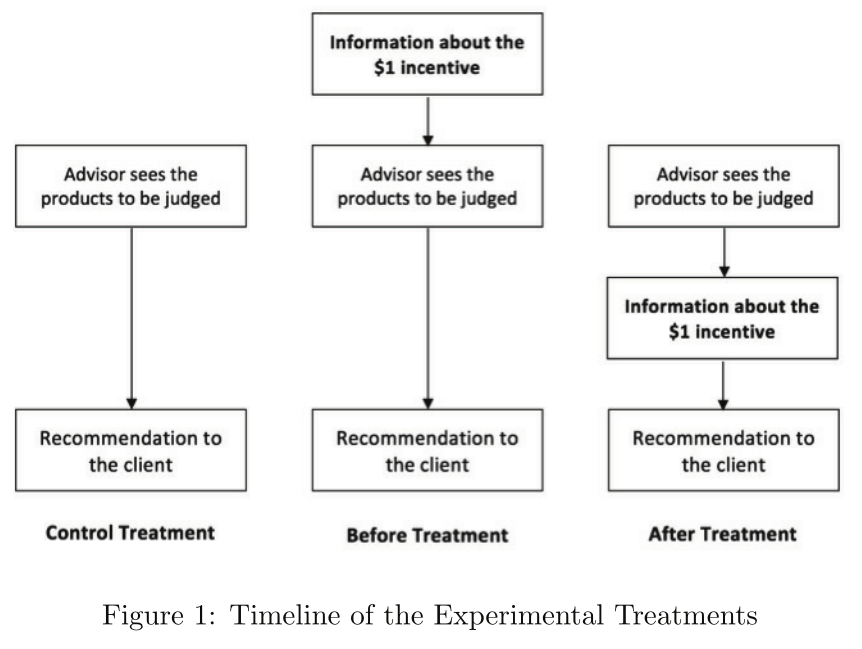

Treatment:根据自欺动机(NO/Before/After)

Control T.;Before T.;After T.

结果预测

Hypothesis 1: In the Risk-Return, recommend A(Before) > **A(After)

S-D=Risk Preference+Fairnes

Hypothesis 2A: In the Dominance, recommend A(Before) = A(After)

S-D==Risk Preference

Hypothesis 2B: In the Dominance, recommend A(Before) > A(After)

S-D==Fairness

Hypothesis 3: In the Obvious-Dominance, recommend A(Before) = A(After)

实验结果

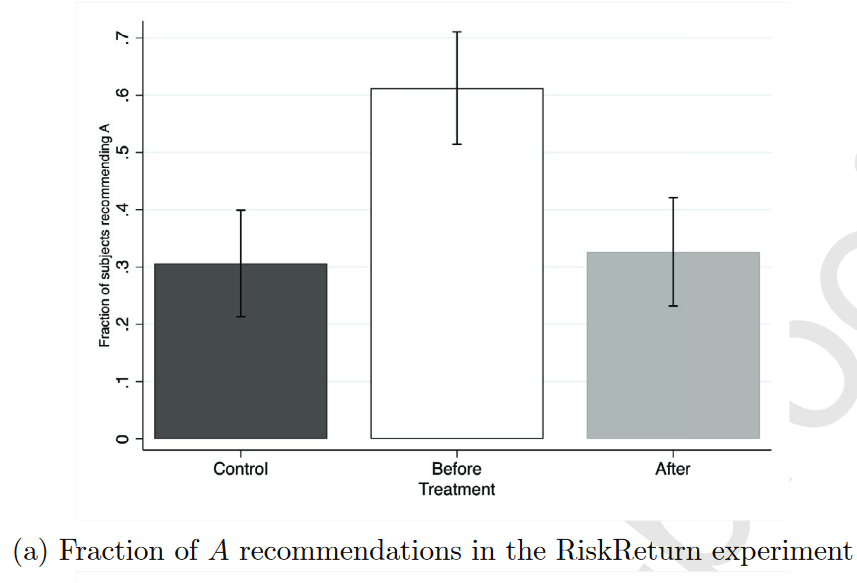

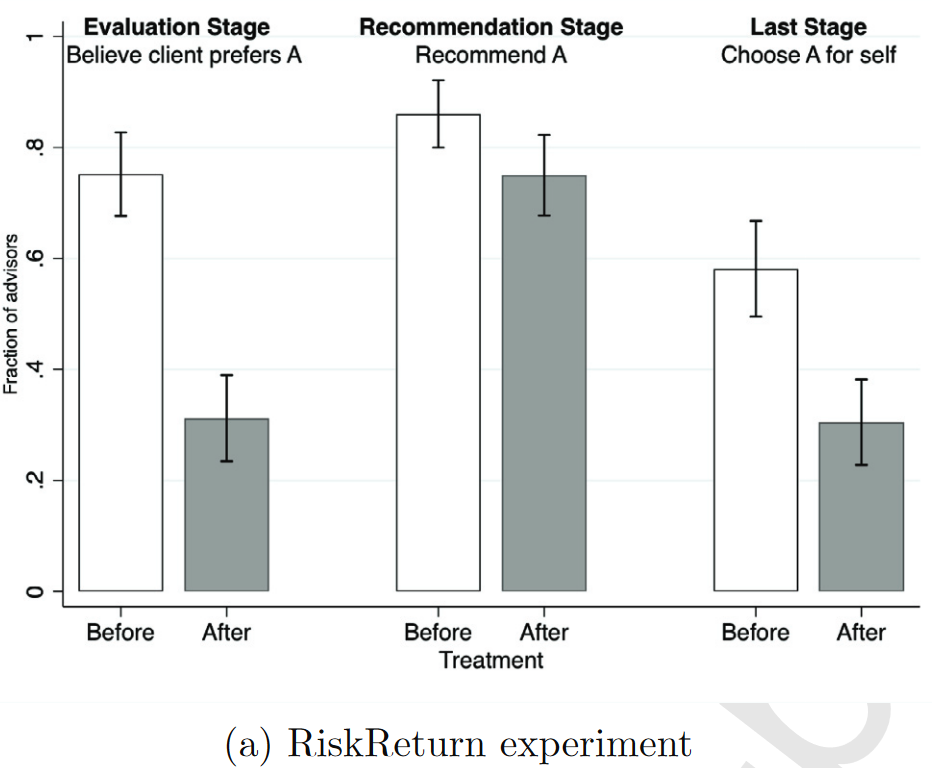

The Risk-Return Experiment

Hypothesis 1. 成立

选择A(激励性选项)比例为:

Control=30.6%

Before=61.2%

After=32.7%

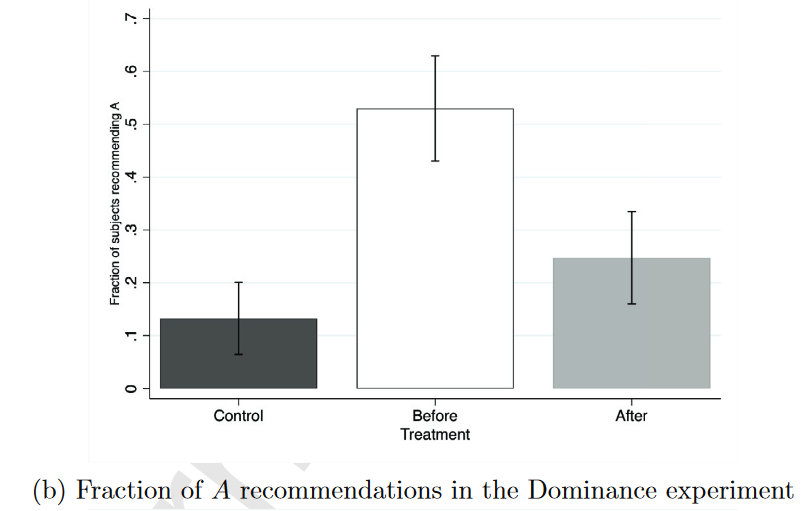

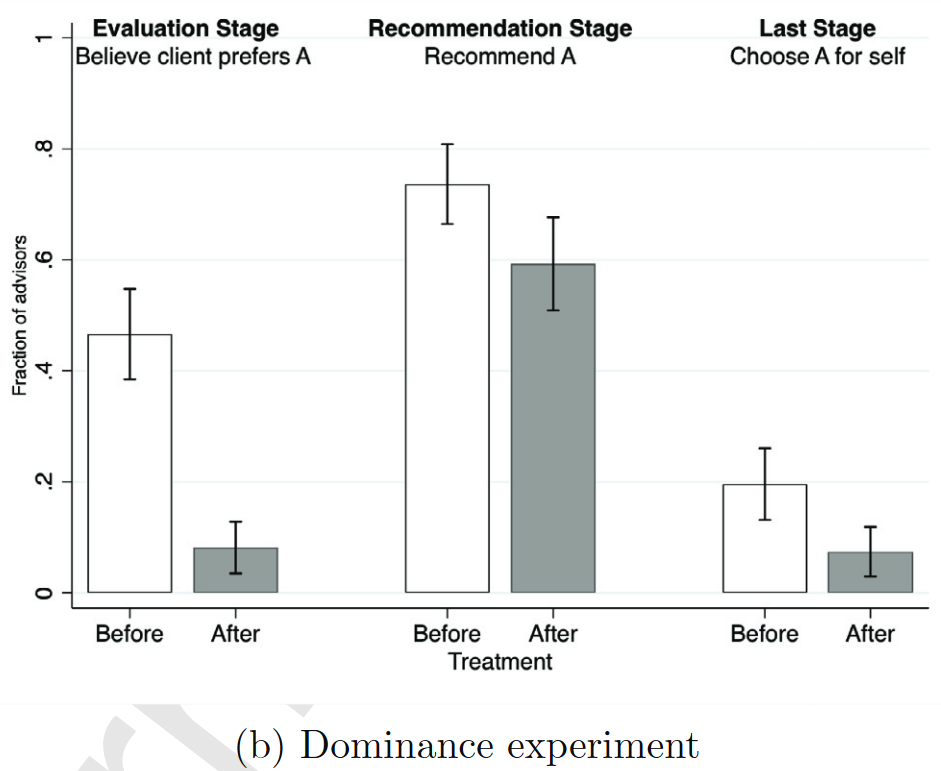

The Dominance Experiment

选择A(激励性选项)比例为:

Control=13.3%

Before=53%

After=24.7%

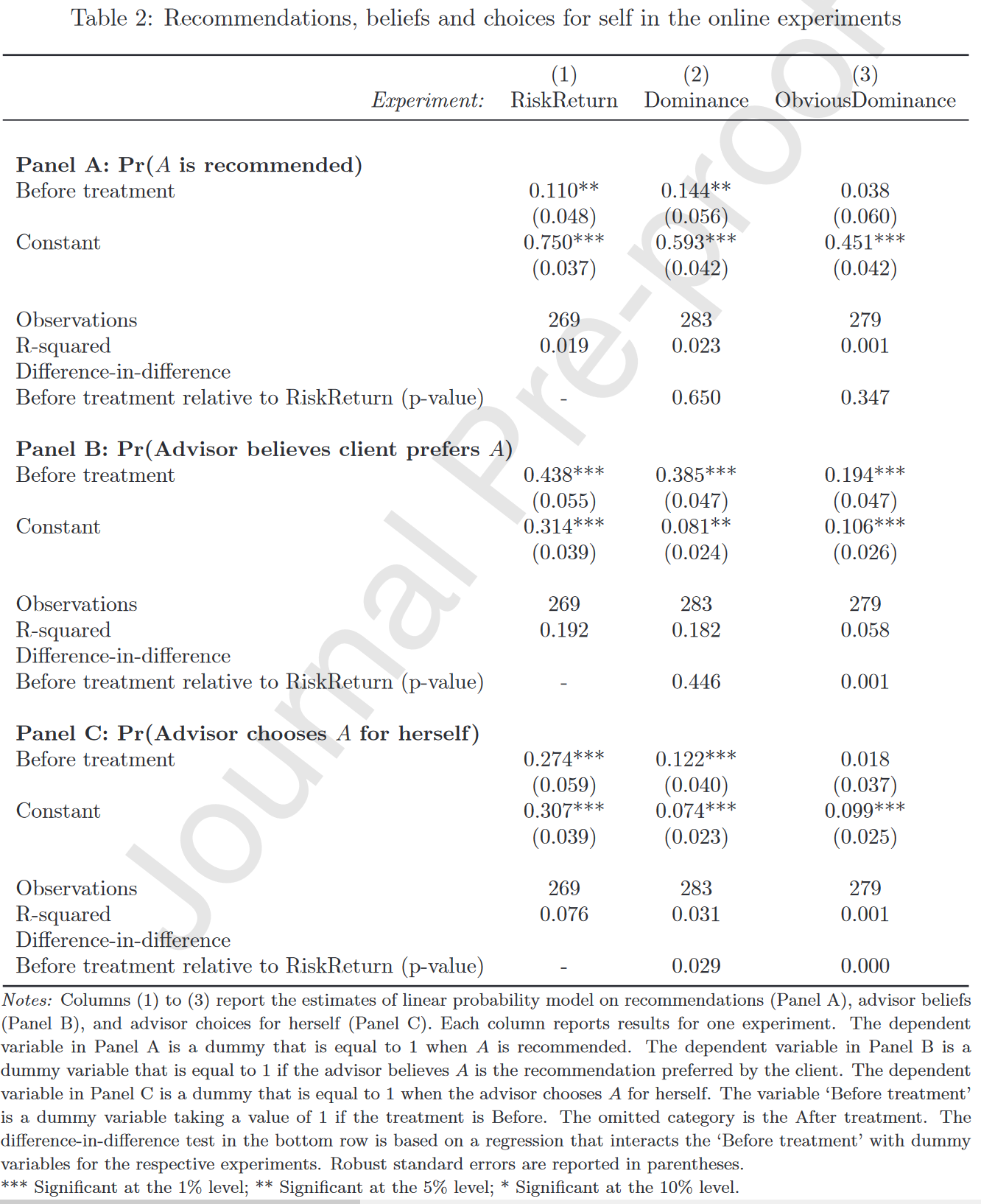

DID 图片

Difference-in-difference:compare the effect of the Before and Control treatments on recommendations in the Dominance experiment to those in the Risk-Return experiment

the coefficient Before treatment X Dominance 接近0且不显著

说明自我欺骗哪怕只有一点点机会都可以实现

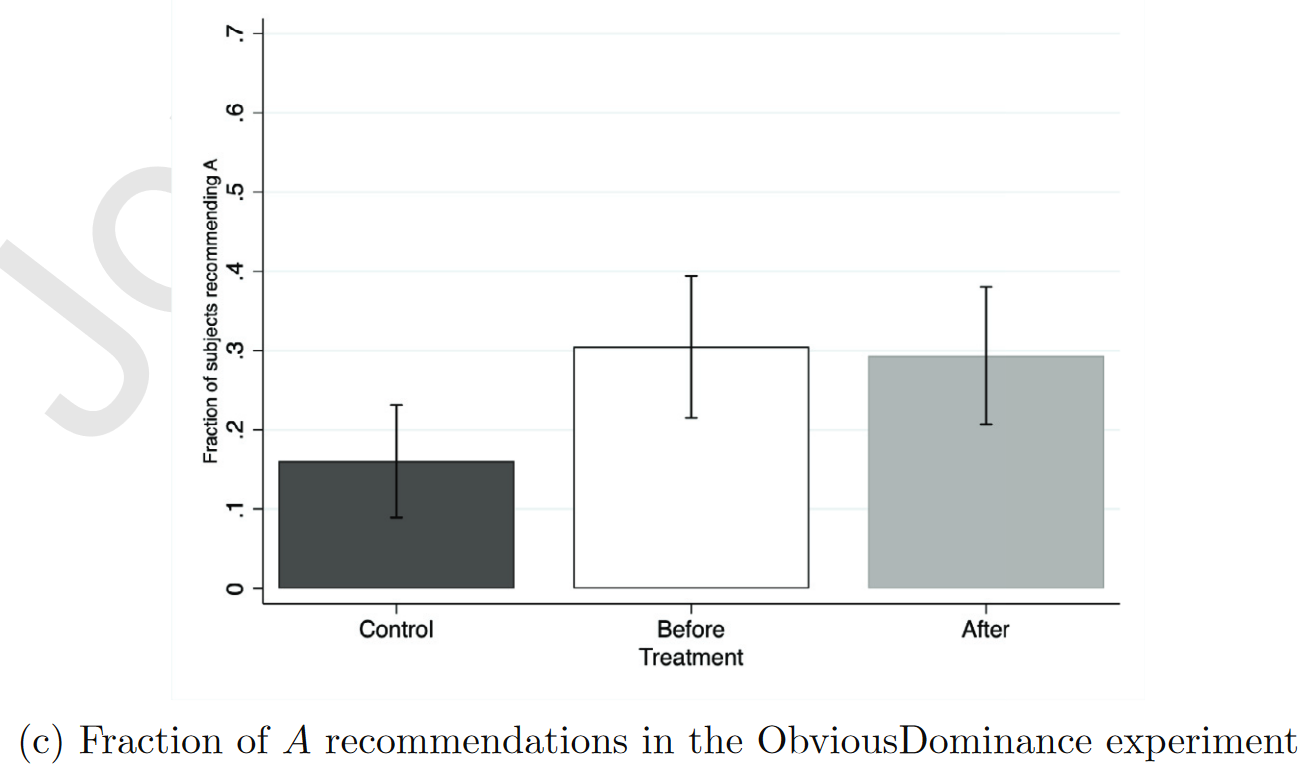

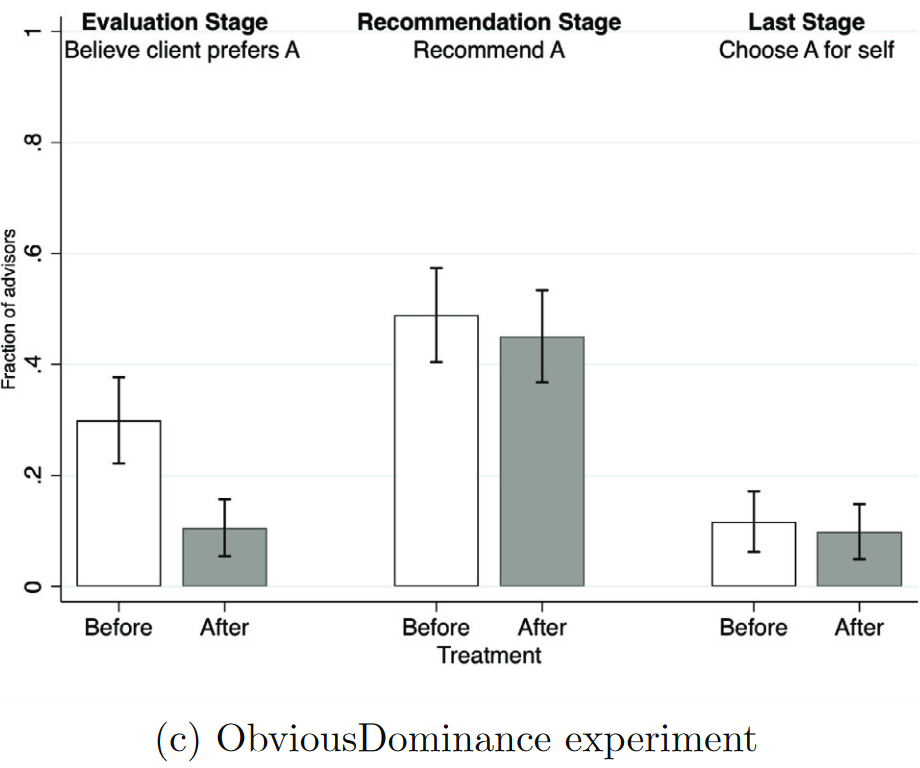

The Obvious-Dominance Experiment

选择A(激励性选项)比例为:

Control=16%

Before=30.5%

After=29.4%

Mechanisms of Self-Deception: Belief Distortion and Choice for Self

自我欺骗的直接证据

实验设计

Three Experiments (RiskReturn, Dominance and ObviousDominance) × Before & After

被试决策前提取信念:你认为被试更喜欢哪个选择?

paradigm Babcock et al. (1995)

没有激励信念??那被试完全可以欺骗实验者啊

作者做了一个辩解:存在文献说明激励和不激励信念结果都一样(e.g., Friedman and Massaro, 1998; Sonnemans and Offerman, 2001; Trautmann and van de Kuilen, 2014; Hollard, Massoni and Vargnaud, 2016)

但是这里是有欺骗实验者的动机的!不应该这样

最后要求被试自己做一个选择获得收益(随机抽1实现)

Risk-Return experiment

investment A was a 50-50 lottery between $0.50 and $1

Investment B was a 50-50 lottery between $0.25 and $1.75

Dominance experiment

investment A was a 50-50 lottery between $0.50 and $1

Investment B was a 50-50 lottery between $0.50 and $1.50

Obvious-Dominance Experiment

investment A was a 50-50 lottery between $0.50 and $1

Investment B was a 50-50 lottery between $1.25 and $1.75

实验结果

Beliefs

自欺动机强的普遍推荐A率高,而且Before和After差距大

RiskReturn

Preferrable Choice(Before)==75.2%; Preferrable Choice(After)==31.4%;

Dominance

Preferrable Choice(Before)==46.6%; Preferrable Choice(After)==8.1%;

ObviousDominance

Preferrable Choice(Before)==29.9%; Preferrable Choice(After)==10.6%;

Recommendations

网上实验结果复现了线下的结果;但是Before和After差距变小

Choice for Self.

RiskReturn

Choose A=58.1%(Before); 30.7%(After)

Dominance

Choose A=19.6%(Before); 7.4%(After)

ObviousDominance

no gap in A choices

Choose A=11.7%(Before); 9.9%(After)

Discussion

Stylized Framework ——Benabou (2015)

- 专家会从选择、推荐选项一致中获得自我形象效用

- 自我欺骗采取观察者有偏信念更新(Biased Updating)的形式

Cost Of Self-Deception

文章的理论模型假设自我欺骗成本是常数(默认是0)

假设在后期研究中可以放宽来缩小 the scope for self-deception

Conclusion

相关文献:专家的错误建议;激励扭曲判断

(Steinman et al., 2001; Moore et al., 2010; Cain, Loewenstein and Moore, 2011; see also Malmendier and Schmidt, 2017)

Belief-Based Utility

(e.g., Loewenstein and Molnar, 2018; B ́enabou and Tirole, 2016; Golman et al., 2016; Mobius et al. 2014)

过度治疗的抑制

先让专家有选择,再让专家得知欺骗动机

评价和反思

自我欺骗的信念测度问题

自我欺骗的是不是要测度出信念的矛盾(Belief Distortion)

本文只有一个信念(比较的是Before和After)

自我欺骗的信念测度不用激励?

没有激励很可能欺骗研究者(换成精准测度范式的话又和Nudge相似)

没有提供个体层面的精准测度

- Before和After的存在的确促进了有偏推荐——但是一部分本就风险偏好的人他们的选择被忽视了(只要你本来就想推荐风险偏好的选项,那就不需要做任何trade-off)