摘要

我们表明使得建议偏离的一次性激励就具有持续性影响(Persistent Effect)

给别人的建议和自己的选择因为维护一致性的需要而相互联系

实验中一些专家获得奖金以推荐一种彩票,只有风险爱好者才能推荐给客户

之后他们自己选择向另一个客户提出第二个建议,但没有任何奖金,这些顾问选择风险彩票,并建议第二次比从未获得奖金的对照组顾问多六倍。

实验结果与目前呈现理论一致,该理论基于专家们对廉洁形象的担忧

实验综述

许多专家的建议是有偏的,这种偏见在潜在利益冲突消失后仍然存在

第二次建议任务(无奖励)以前接触过奖励的专家推荐风险彩票的可能性是控制组专家的六倍

Simple Theory

激励下提供有偏建议被认为是不道德的

与此一致,我们实验中最初获得奖金的顾问中,几乎有一半不推荐风险彩票。

人们希望避免自己的建议被推断有偏

为表明自己的道德诚信,建议必须不受奖金的影响

这需要在提供建议方面保持一致

即使奖金被移除后重复有偏建议

探索专家如何确定适当的建议

35%至45%的专家最初建议被奖金驱使,也为自己选择了风险彩票

这一发现表明,他们把自己的选择与他们认为适当的建议联系起来,然后必须做出相应的选择,以避免表明他们的腐败

这与另一种推理相反,即他们可以自私地假设目标客户是风险偏好的,如果他们为自己选择的彩票与之前的建议不同,就不会有负面信号

此外,如果这些发现没有在受控实验中确定,它们将符合风险寻求顾问自行选择的补偿计划,以奖励广告风险选择。

研究外在地改变奖金存在性,奖金以持续和因果的方式,影响专家的重复建议和个人选择

相关文献

Adviser Behavior

Foerster et al. (2016) 不是客户的个人特征,而是个人顾问的简单固定效应,解释了客户投资组合风险最大的变化

Linnainmaa et al. (2016) 样本中的顾问选择了与各自客户持有的相同回报追逐和积极管理的基金

Experiment

Gneezy et al. (2016) 只提供一次投资建议

Babcock et al. (1995) 在法庭上扮演原告和被告

被试在了解案件细节前知道自己的角色,则要达成一致要困难得多

Loewenstein et al. (1993)

Role-induced dispositions lead people to align their judgment

Konow (2000)

Festinger and Carlsmith (1959)

Trivers (2011)——Schwardmann and van der Weele (2016)

Mijovi ́c-Prelec and Prelec (2010)

Kunda (1992):how cognitive dissonance and (motivated) self-perception relate

Akerlof and Dickens (1982) 认知失调的经济模型引入

以上这些效应如何减少建议提供中利益冲突的有效性

Harmful Consistency:维持Consistency的效用本身降低了效率

Falk and Zimmermann (2017a,b) 个人决策偏离;重复决策是一种维持自我形象的手段

Eyster (2002) 理论分析Consistency作为掩盖过去错误(past mistake)的手段

We show such harmful consistency can emerge through conflicts of interest and how it persistently affects the role of advisers as information multipliers.

Adverse Effects Of Bonus Payments

(Christoffersen et al., 2013; B ́enabou and Tirole, 2016)

how the resulting conflicts of interest shape the self-perception and attitudes of those exposed to these incentives(Zingales, 2015; Cohn et al., 2014)

Moral Reasoning And Economic Behavior

人们有自我形象效用,通过个人行为推断自己的类型

(Bodner and Prelec, 2003; B ́enabou and Tirole, 2004)

in particular, their own moral values(B ́enabou and Tirole, 2011; Falk and Tirole, 2016)

不完全说谎从而维护诚实的错觉(Mazar et al., 2008)

人们如何处理威胁性的信息

Gino et al. (2017) 综述:信息往往不是被客观处理的👉”motivated Bayesians”

”Motivated Bayesians” who employ uncertainty and ambiguity in a self-serving way(Dana et al., 2007; Haisley and Weber, 2010; Exley, 2016)

A Psychological Mechanism

how a preference to appear as an unbiased adviser can lead to a repeated bias in further advice and in own choices

Appendix A:Model(Self-signalling)

Overall Utility:

Expected Monetary Payoffs

Psychological Cost of not giving appropriate advice

反应了他们推荐的实际上并不是他们认为最优选择带来的认知失调

文章论证这一效用是独立于偏好存在的

Diagnostic Dis-Utility of learning from one’s current actions that previous advice was biased

based on a model of self-signaling, dual-self model(”diagnostic self”)

强调产生效用是事后的

(e.g. Bodner and Prelec, 2003; B ́enabou and Tirole, 2011; Grossman and van der Weele, 2017)

用于刻画维护关于自我动机的自利信念和采取矛盾的行动之间的矛盾

我觉得我就是风险偏好的人(自利信念的辩护)👉我的决策和信念一致

我知道我不是风险偏好,但是我还是推荐风险偏好的选择

效用理论的应用

To see this, consider an adviser whose recommendation is corrupted: His cost of giving biased advice, i.e. the cost of recommending something he does not consider advisable, is thus smaller than the (material) benefit he gets from giving such advice. If the adviser also is sufficiently concerned about his self-image, he then needs to continue to give the same biased advice again when the conflict of interest has disappeared. The reason is that in order to entertain the notion that the initial advice was unbiased, it should be unaffected by the presence of any external incentive. However, changing advice after the conflict of interest disappeared signals the opposite.

一个人如果选择了激励性选项:说明

The reason is that in order to entertain the notion that the initial advice was unbiased, it should be unaffected by the presence of any external incentive. However, changing advice after the conflict of interest disappeared signals the opposite.

专家被视为公正的偏好👉建议提供的持续影响

if 一个顾问的建议被激励左右,然后必须为自己选择一个选项

他没有选择自己的推荐选项👉说明他以前是黑心的

因此如果他们的形象担忧(image concerns)足够强烈,会服从自己的推荐

实验设计

Sender&Receiver Game 改版

扮演给客户提供建议的专家

专家选择推荐的投资建议

客户从同场被试里面随机抽,直接给出场费

Recommendation👉identify person‘s risky/neutral/safe reference

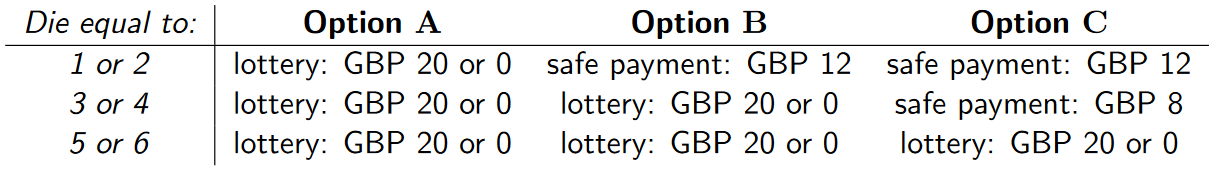

- Option between A&B:只有风险偏好的人会选择A

- Option between B&C:只有风险厌恶的人会选择C

Table 1: Description of the investment options as shown to advisers, ”lottery” is a fair coin toss.

这个彩票量表是Hsee and Weber (1997) and Holt and Laury (2002) 的简化版

STEPS

Step 1 – first recommendation

发送者被试选择一个选项,并将选项放入信封,所有的信封集中在一个盒子里

被告知将从盒子中随机抽取一个信封给接收者,他选择一个选项

Step 2 – Own choice

所有发送者必须对于同样的表格做出自己的选择,此时选择决定自己的收益

同样的收集流程,最后也会被随机抽1

Step 3 – Second recommendation

流程和R1完全相同

决策情况完全反映R1

Step 4 – Questionnaire

基本信息;冒风险的意愿

Step 5 – Payoff

总共收集三个盒子,从每个盒子中抽取一个信封,得到抽样的R1、O和R2

抛投资得到一个骰子点数

被试依次离场,抛骰子、抛硬币来确定收益,进行支付

TREATMENT

NO BONUS versus BONUS

奖金针对风险偏好的选项A,只提供给R1,同时告知后面不会再有奖金

得知投资选择信息前告诉他奖金

Verifiability

为了确保顾问相信,如果随机被选择向客户展示建议,客户将会实际看到

被选中的专家的信封会被接受者签名,专家会收到信封复印件

General procedures

99名被试

结果预测

First recommendation R1

NO BONUS 没有金钱激励

被试没有关于过去行为的信号价值👉No Image Concerns

只有发送错误信号带来的负效用👉 那么被试决策只按照他的真心建议来

BONUS 金钱激励

被试除了要尝试避免推荐错误选项,同时也收到金钱激励选择A

Prediction 1: More advisers in BONUS than in NO BONUS recommend option A

Own Choice O

为自己决策时,提供错误建议带来的负效用

不用考虑 In NO BONUS,没有Image Concerns→推荐他们认为最优的选项

In BONUS, 有Image Concerns(推荐他们不认同的选项)

原来认为A最优→始终推荐A

原来认为B最优👉在激励和推荐错误选项权衡中选择坚持推荐B👉没奖金选B

Prediction 2: More advisers in BONUS than in NO BONUS choose option A for themselves.

可以用来具体衡量前后的重复偏差

Second recommendation R2

并不用于收益结算,用于测度重复偏差

Prediction 3: More advisers in BONUS than in NO BONUS recommend option A.

实验结果

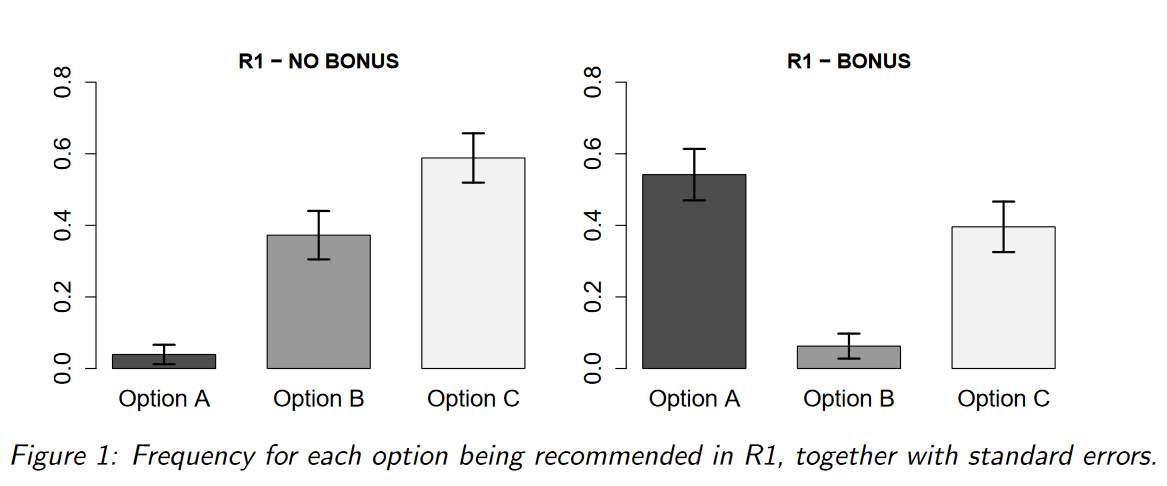

Results for R1

R1:NO BONUS 为3.9%,BONUS为54.2%

一半的被试激励下没有选择A,说明提供这种建议存在非金钱成本,而且对于相当一部分专家来说,这些费用超过了奖金支付的效用。

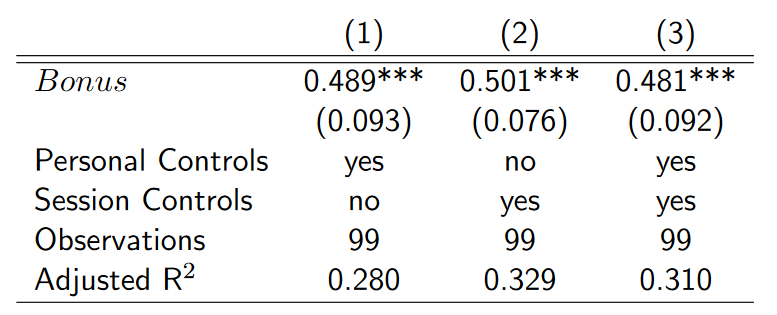

回归检验:被解释变量为推荐A的虚拟变量,Bonus为是否受到激励

vector ci 控制变量:收集指示受试者的年龄、性别、每月可用预算、原产地、受试者持有或追求的最高学位以及研究领域的控制变量

si:Session fixed effects

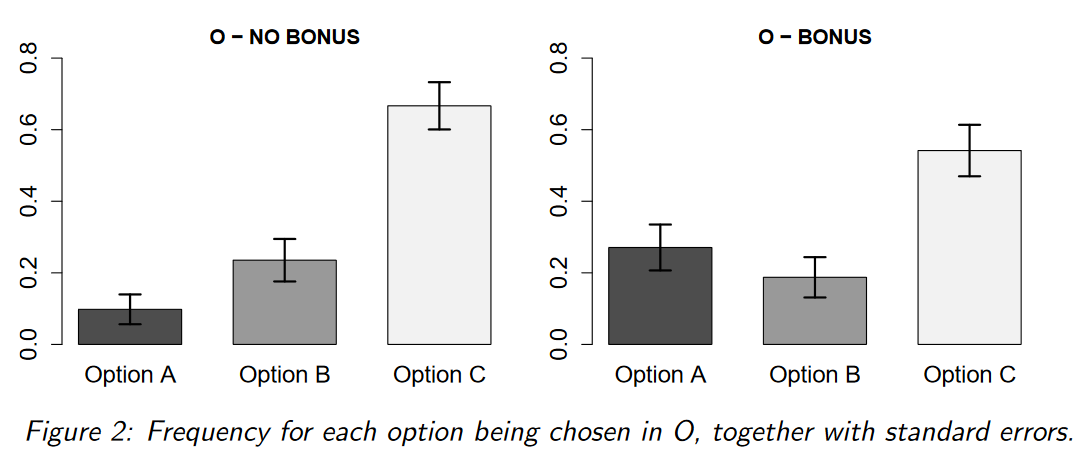

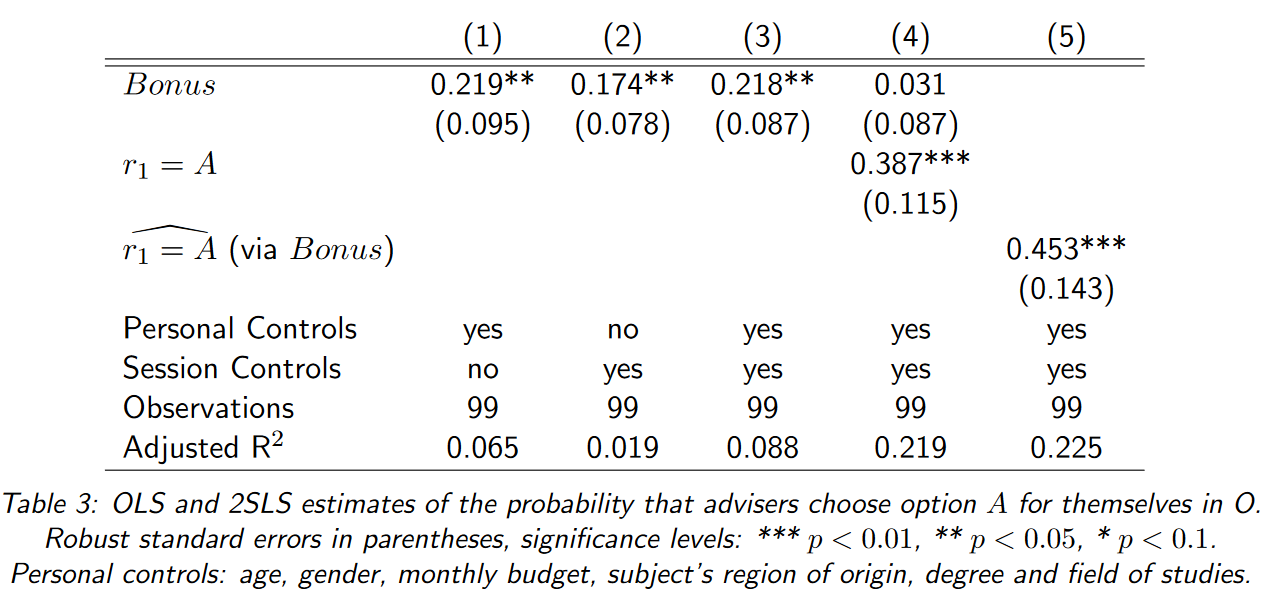

Results for O

O:NO BONUS 为9.8%,BONUS为27.1%

回归检验证实

更准确地量化奖金对顾问自身选择的影响(estimate conditional effect)

将奖金对自身选择的无条件影响(unconditional effect)除以对R1的影响

这假定此通道是奖金如何影响后续选择的唯一方法

R1=50.3%,O=17.3👉

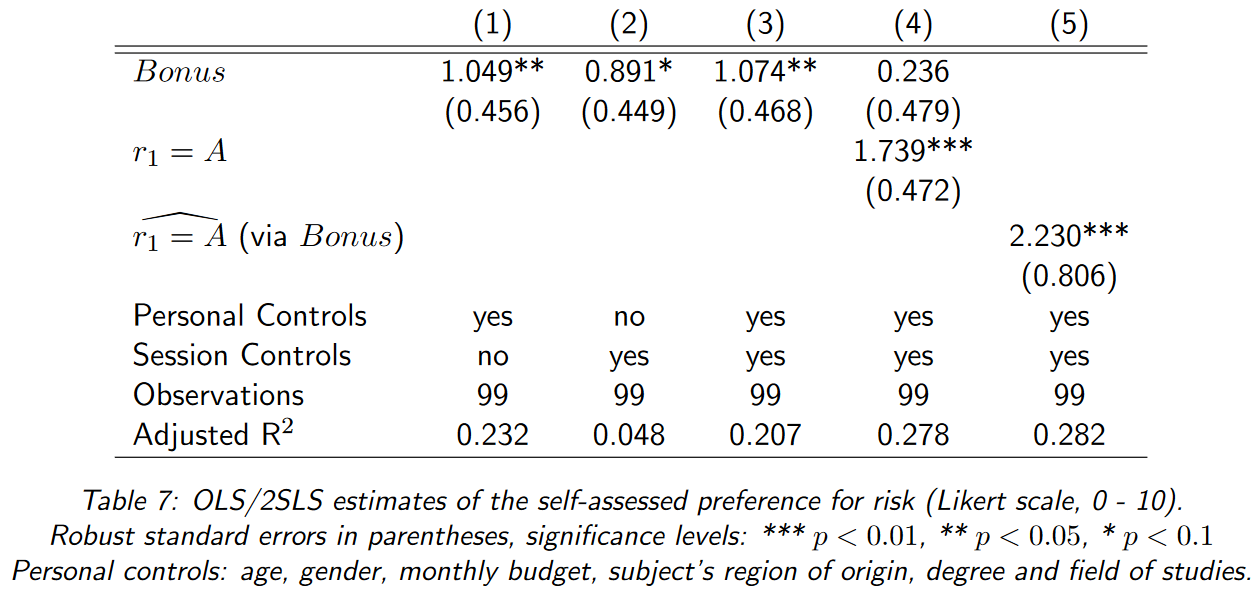

上述估计值是Wald/分组估算器,在2SLS估计的第二阶段,无需进一步控制即可获得。在这种回归中,随机分配到奖金处理将首先用于预测 R1 中选项 A 的建议,然后根据这些预测,在第二步中估计初始建议对自身选择的影响。在表 3 的第 5 列中,我们在添加附加控件时呈现第二阶段结果(因此,相应的第一阶段结果在表 2 中的第 3 列中报告)。当我们添加这些控件时,最初建议的中介效应(通过奖金的初始存在明确建模)会增加至 45.3 个百分点的转移,即以后为自己选择风险选项的可能性。请注意,捕获初始建议的中介效果也增加了回归模型的解释能力。与没有明确建模的介质效应的第 1 列到第 3 列相比,调整后的 R2 在列 4 和 5 中增加记录。

Note that the above estimate is the Wald/grouping-estimator one would also obtain in the second stage of a 2SLS-estimation without further controls. In this regression, random assignment to the BONUS-treatment would be first used to predict recommendations for option A in R1 and then, based on these predictions, the effect of the initial recommendation on own choices would be estimated in the second step. In column 5 of table 3 we present the second-stage results when additional controls are added (the corresponding first stage results are thus reported in column 3 in table 2). When we add these controls, the mediating effect of the initial recommendation, modeled explicitly through the initial presence of the bonus, increases to a 45.3 percentage-point-shift in the probability of later choosing the risky option for oneself. Note that capturing the mediating effect of the initial recommendation also increases the explanatory power of the regression model. This is documented by the increase in the adjusted R2 in column 4 and 5, relative to columns 1 through 3 where the mediating effect is not explicitly modeled.

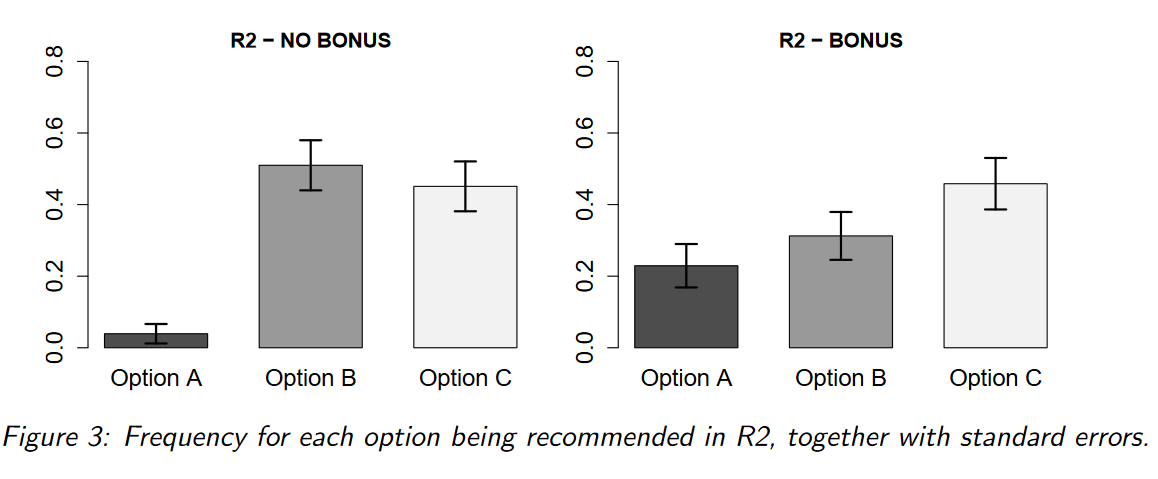

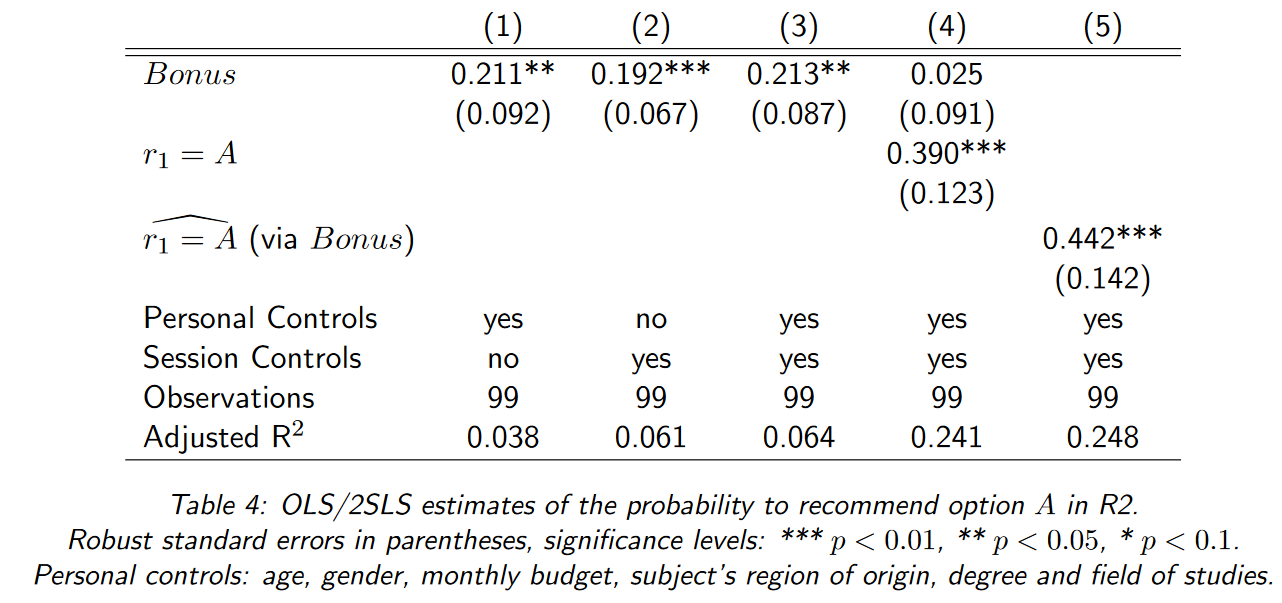

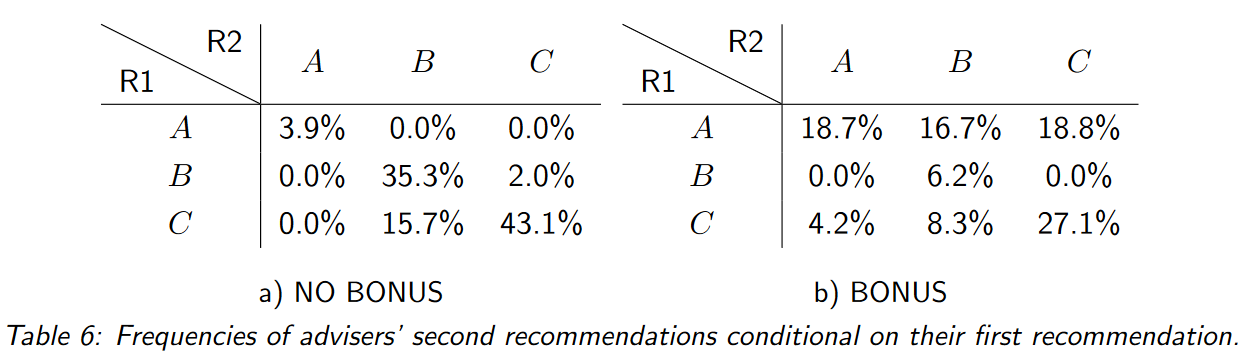

Results for R2

NO BONUS实验局中前后的结果一致

尽管没有金钱激励,但是BONUS实验局的R2是NO BONUS实验局的6倍(22.9%)

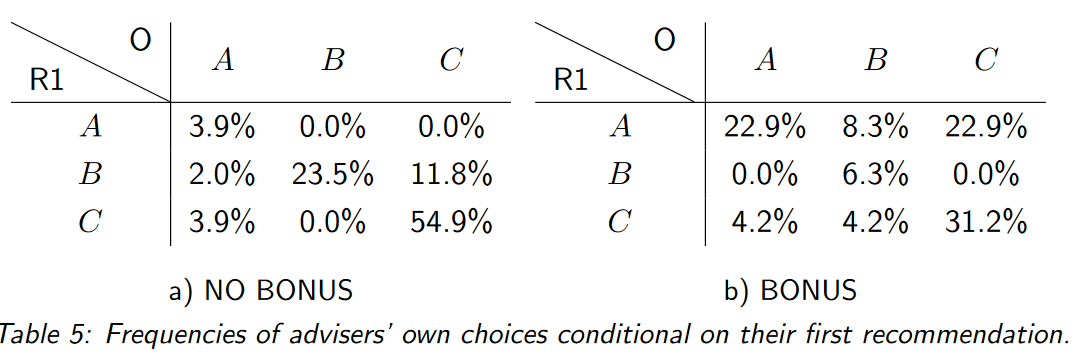

Further results

被试的两个选项频率分布:

82.3% of our observations in NO BONUS are in line with the predicted consistency

Again, this leaves only a small fraction, 8.4% of our observations, unexplained.

问卷导入的回归检验

总结与讨论

Lasting And Causal Effect(incentives to bias advice)

激励对建议提供的偏离有持久和因果上的效应

35% 到 45% 的最初建议受奖金偏离的专家,他们的第二次建议依然保持不变(无激励)

提供的有偏建议是成本高昂(维护自己的建议会一错再错)

锚定效应的解释行不通

社会形象问题

研究结果主要由自我形象引起的,但社会形象在许多重要情况下也可能很重要

偏见的产生和透明性和持久性

- 如果这种推理在潜意识中发生,那么顾问们相信,尽管他们实际上有偏见,但他们的行为在道德上是完好无损的。因此,调查顾问是否意识到最初的偏见及其持久性对于判断其影响以及最终能否追究他们的责任可能很重要。

评价和反思

援引Gneezy设计,经济上证实了Self-Signalling预测的一致偏差

- 没有激励的时候为了照顾自我形象推断,因此选择维持前面的选项

实验设计=风险偏好测度范式+Gneezy S-D设计

- 实验设计本身创新度不够,但是针对的结论还可以(persistent effect)

- Treatment就一个

激励S-D的范围不是全体

你本来就认为A好,A被激励,你当然选择A

我认为B好,A被激励,我依然推荐B

只有那些认为A不好但是推荐A,为了维持自我形象下坚持原选项才好

会造成个体层面的数据很难解释

出现数据难以解释的个体?激励A的时候你选了B,没有激励的时候你选A(叛逆)

一次随机选取一位实现+一次为自己选👉会不会激发被试的差异化选择?(A,B,C我都选选)→混淆结果

不能解释事后自利偏差的影响

实验的确能做出结果,但是只要被试形成独立于他对客户偏好推断的信念,就完全可可以做出不同的选择

被试第一次选择A,为自己选B(A过后形成自利有偏信念:我觉得对方是风险偏好的,可我清楚我自己不一样)

没有区分自我形象和社会形象:监督者

该实验主要是自我形象的质疑